Small Business Payroll Tracker – Easy-to-Use Payroll Calculator in Google Sheets!

Struggling to track payroll for your employees? Our Payroll Tracker Spreadsheet is the perfect solution for small businesses, freelancers, and entrepreneurs who need a simple and efficient way to calculate employee wages, deductions, and net pay.

🔹 What’s Inside?

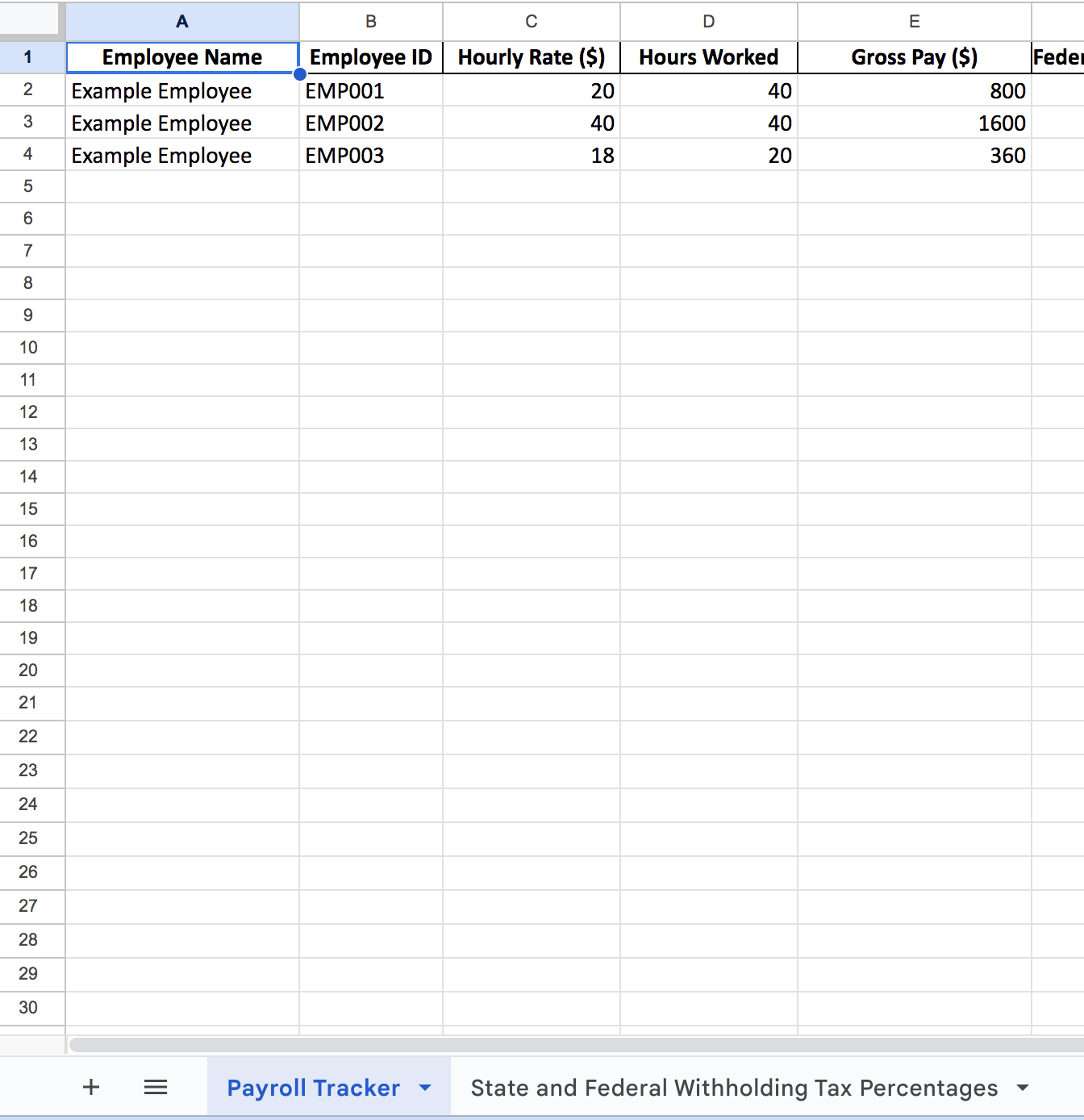

✔️ Customizable Google Sheets spreadsheet for tracking payroll efficiently

✔️ Automatic calculations for gross pay, federal & state tax withholding, Medicare, and Social Security

✔️ Pre-filled tax deduction formulas (adjustable for your state’s rates)

✔️ Works with Excel & Google Sheets – No software needed!

✔️ Designed for small businesses – Supports multiple employees

💡 Who Is This For?

✅ Small business owners & freelancers

✅ Entrepreneurs managing their own payroll

✅ Businesses with a few employees needing a simple payroll tool

🎯 Why You Need This?

✔️ Save time calculating payroll manually

✔️ Ensure accurate tax withholdings & deductions

✔️ Simplify financial record-keeping for tax season

🛒 Get instant access & start managing payroll effortlessly!

Struggling to track payroll for your employees? Our Payroll Tracker Spreadsheet is the perfect solution for small businesses, freelancers, and entrepreneurs who need a simple and efficient way to calculate employee wages, deductions, and net pay.

🔹 What’s Inside?

✔️ Customizable Google Sheets spreadsheet for tracking payroll efficiently

✔️ Automatic calculations for gross pay, federal & state tax withholding, Medicare, and Social Security

✔️ Pre-filled tax deduction formulas (adjustable for your state’s rates)

✔️ Works with Excel & Google Sheets – No software needed!

✔️ Designed for small businesses – Supports multiple employees

💡 Who Is This For?

✅ Small business owners & freelancers

✅ Entrepreneurs managing their own payroll

✅ Businesses with a few employees needing a simple payroll tool

🎯 Why You Need This?

✔️ Save time calculating payroll manually

✔️ Ensure accurate tax withholdings & deductions

✔️ Simplify financial record-keeping for tax season

🛒 Get instant access & start managing payroll effortlessly!

Struggling to track payroll for your employees? Our Payroll Tracker Spreadsheet is the perfect solution for small businesses, freelancers, and entrepreneurs who need a simple and efficient way to calculate employee wages, deductions, and net pay.

🔹 What’s Inside?

✔️ Customizable Google Sheets spreadsheet for tracking payroll efficiently

✔️ Automatic calculations for gross pay, federal & state tax withholding, Medicare, and Social Security

✔️ Pre-filled tax deduction formulas (adjustable for your state’s rates)

✔️ Works with Excel & Google Sheets – No software needed!

✔️ Designed for small businesses – Supports multiple employees

💡 Who Is This For?

✅ Small business owners & freelancers

✅ Entrepreneurs managing their own payroll

✅ Businesses with a few employees needing a simple payroll tool

🎯 Why You Need This?

✔️ Save time calculating payroll manually

✔️ Ensure accurate tax withholdings & deductions

✔️ Simplify financial record-keeping for tax season

🛒 Get instant access & start managing payroll effortlessly!