The Difference Between Bookkeeping and Accounting: What Small Business Owners Need to Know

If you're a small business owner, you've probably heard the terms bookkeeping and accounting used interchangeably. While both are essential for managing business finances, they serve different purposes.

Understanding the difference between bookkeeping and accounting can help you determine which services you need and how to keep your finances in order.

What is Bookkeeping?

📌 Bookkeeping is the process of recording and organizing financial transactions. It ensures that your business has an accurate record of income and expenses, making it easier to track cash flow and prepare for tax season.

Key Tasks of a Bookkeeper:

✔ Recording daily financial transactions (income and expenses)

✔ Categorizing transactions correctly

✔ Reconciling bank and credit card statements

✔ Managing accounts payable (bills) and receivable (invoices)

✔ Keeping organized financial records

✔ Generating basic financial reports (profit & loss statements, balance sheets)

Bookkeeping lays the foundation for accounting by maintaining clean and accurate records. Without proper bookkeeping, accounting tasks become much more difficult.

What is Accounting?

📌 Accounting is the process of interpreting, analyzing, and summarizing financial data. While bookkeeping focuses on recording transactions, accounting helps business owners make strategic financial decisions based on those records.

Key Tasks of an Accountant:

✔ Reviewing and verifying financial records

✔ Preparing financial statements

✔ Conducting financial analysis for business planning

✔ Filing taxes and advising on tax strategies

✔ Ensuring regulatory compliance

✔ Budgeting and forecasting business growth

Think of bookkeeping as inputting and organizing data, while accounting is about using that data to make informed business decisions.

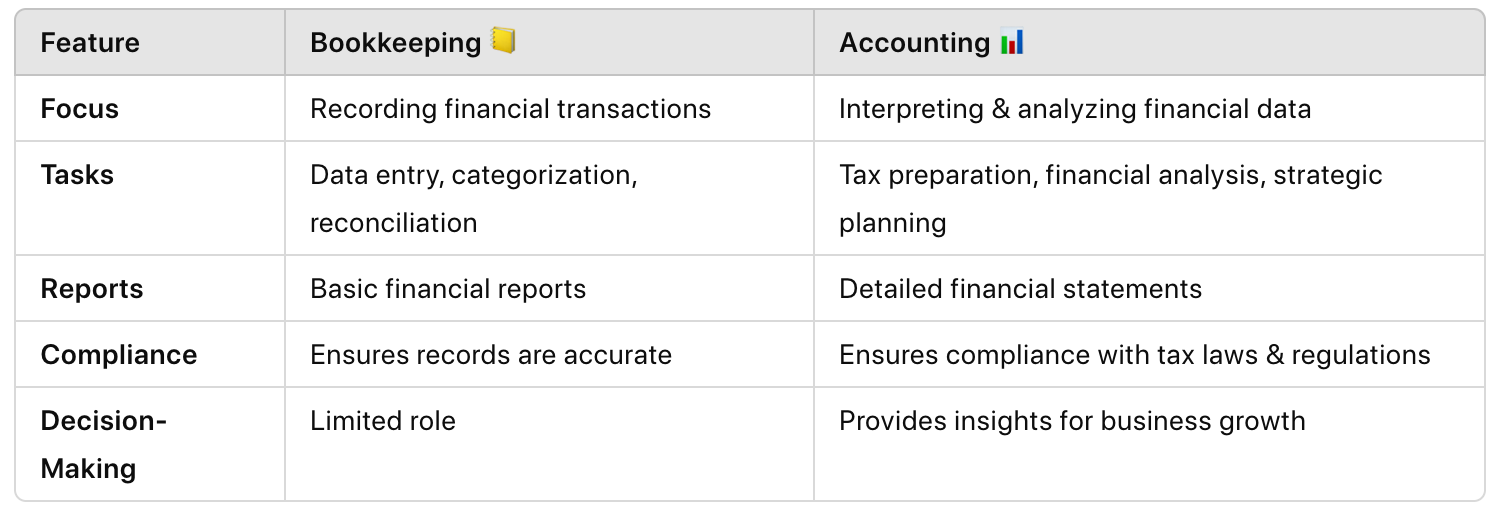

Bookkeeping vs. Accounting: Key Differences

📌 In short: Bookkeeping is about maintaining accurate financial records, while accounting helps you understand and use those records to improve your business.

Does Your Small Business Need a Bookkeeper or an Accountant?

Both bookkeeping and accounting are essential for financial success, but not every business needs both right away.

✔ You need a bookkeeper if:

You need help organizing financial records.

You want to track income and expenses accurately.

You struggle with reconciling bank statements.

📌 Hiring a bookkeeper can free up your time and ensure your financial records are always up to date.

✔ You need an accountant if:

You need tax preparation or planning.

You want to understand your business’s financial health.

You’re planning to apply for a loan or secure investment.

📌 Many small businesses hire a bookkeeper year-round and consult an accountant for tax season and business planning.

How Davidson Summit Bookkeeping Can Help

At Davidson Summit Bookkeeping, we specialize in helping small business owners manage their bookkeeping so they can focus on growing their business.

✅ We offer affordable bookkeeping services starting at just $99/month

✅ We provide easy-to-use templates like our Payroll Tracker Template to simplify payroll tracking

✅ We help businesses stay organized, compliant, and stress-free

Final Thoughts

Bookkeeping and accounting work hand in hand to keep your business finances in check.

🔹 Bookkeeping ensures that all transactions are recorded and categorized correctly.

🔹 Accounting helps interpret that data to guide financial decisions and tax planning.

Whether you’re DIY-ing your books or considering hiring a professional, staying on top of bookkeeping is essential for business success.